Bank Guarantees

Negotiated Price

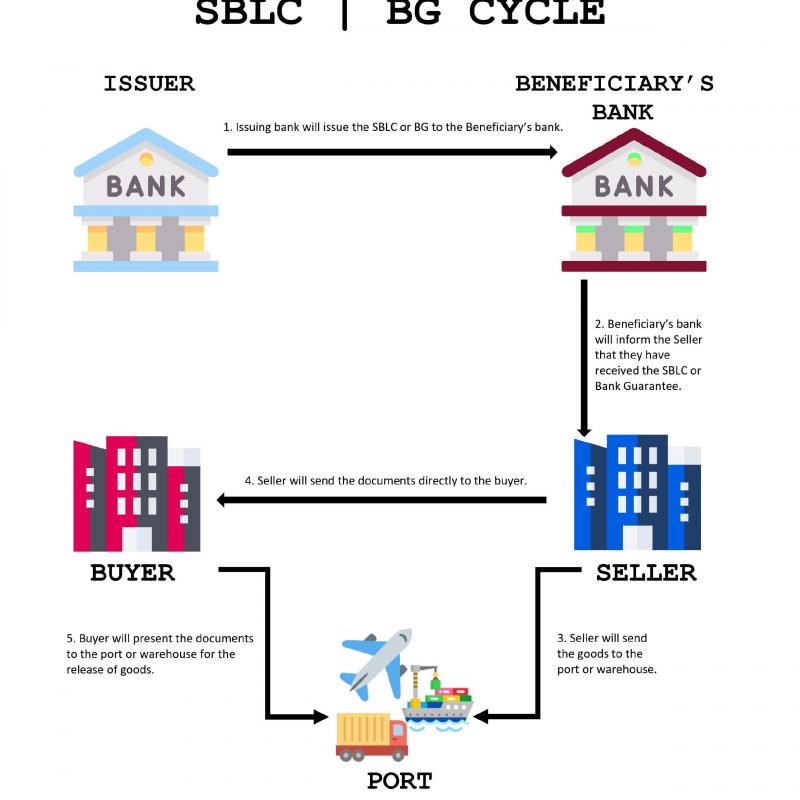

A promise made by the bank for meeting the liabilities of a debtor when a person fails to fulfill his contractual obligations. There are two types of bank guarantees — Direct or indirect:

A direct guarantee is one where a bank is asked to provide a guarantee by its account holder, in favour of the beneficiary.

In an indirect guarantee, a second bank issues a guarantee in return for an already issued guarantee. When the second bank suffers losses when a claim is made against a guarantee, the issuing bank will make sure that it compensates all the losses.

Guarantees provide comfort to the beneficiary; in case the applicant fails to meet his obligations (either financially or by performance) as per the contract made between the applicant and the beneficiary, the beneficiary will have the guarantee to turn to for payment.

Having a guarantee issued in support of a client’s transaction can help the client grow and expand their business by postponing current payments for goods and/or services to a later date, provide comfort to buyers, allow clients to bid on transaction , without requiring that ITF’s clients tie up their available cash.

Following are the different bank guarantee types that are available:

A Bank Guarantee is a versatile tool which can function as a number of instruments: a bid bond, a performance bond, and advanced payment guarantee, a warranty bond, a letter of indemnity, a payment guarantee, a rental guarantee, or a confirmed payment order.

United Arab Emirates

United Arab Emirates