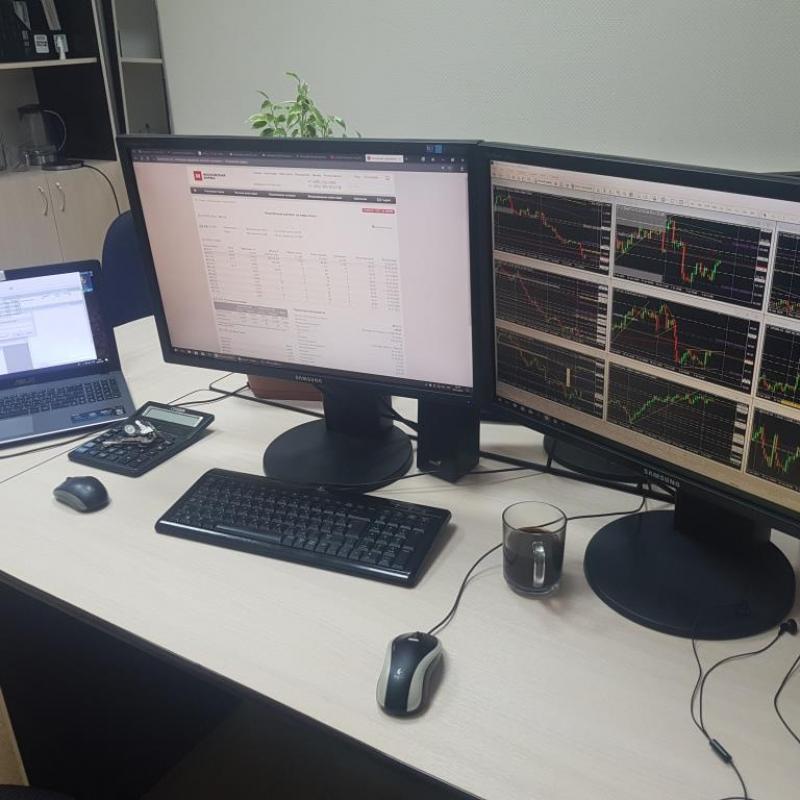

Investment in PAMM Accounts

Negotiated Price

Description

Views: 1446

Manual trading. Global daily and weekly levels and daily price fluctuations are used, therefore it is suitable for both long-term (1-4 weeks) and short-term (intraday) goals. The market profile for popular currency pairs is also taken into account.

Preferred instruments: Currency pairs, CFDs on stocks, Indices, CFDs on raw materials, CFDs on metals ...

Positions are closed manually, by take-profit and by stop signals.

Trading is conducted with a leverage of 1: 100.

The maximum risk for one transaction is 5-25% of the deposit.

The expected annual yield of 70-100% or more, depending on the situation on the forex market.

Russia

Russia